The White House released the 2012 budget today. In the budget it proposes to reimburse USPS for $6.9 billion in overcharges for FERS retirees. But the repayment is spread over 30 years, including $550 million in 2011.

Here is the summary from the White House 2012 Budget outlining provisions for USPS:

The Administration recognizes the enormous value of the Postal Service to the Nation’s commerce and communications, as well as the urgent need for reform to ensure the future viability of USPS. Therefore, the Budget proposes specific short-term financial relief measures, grounded in principles of fiscal responsibility as well as sound financial management, and the Administration will work with the Congress and postal stakeholders to secure necessary reforms. As to the structure of relief, the Budget would improve USPS financial condition by returning to USPS surplus amounts it has paid into its OPM account for its share of Federal Employee Retirement System costs. OPM has determined this surplus is approximately $6.9 billion, which would be paid back to USPS over 30 years, including an estimated $550 million in 2011. Secondly, the Budget proposes to restructure USPS retiree health benefits payments that were specified by the 2006 Postal Act. This change would still prudently pre-fund retiree liabilities, but on an accruing cost basis rather than the arbitrary amounts fixed in current law, which do not allow for the dramatic shifts in demand or workforce size that USPS has experienced in recent years. This restructuring and near-term deferral would provide USPS with $4 billion in temporary financial relief in 2011. Over the 2011 to 2021 budget period this proposal has an estimated deficit effect of $5 billion. See the Office of Personnel Management section of this Appendix for more information on this proposal.

These steps to provide USPS with the breathing room necessary to continue restructuring its operations without severe disruptions must be coupled with meaningful reforms to its business model to make USPS viable for the medium- and long-term. Postal volumes have dropped precipitously in the last few years due to the economic crisis and longer-run shifts in communication technologies and use shifts that have created new challenges even as they propel innovation and revolutionize our economy. The Postal Service needs the flexibility to adapt to these changes and higher public expectations for customer service. To that end, the Administration’s discussions with the Congress and others will be guided by the goals of allowing the Postal Service to: 1) Realign its infrastructure, facilities, processing and delivery systems to continuously improve efficiency; 2) Promote an adaptive, 21st Century workforce; and 3) Accelerate value creation and enhance service to the public while respecting fair competition in the marketplace.

And from the OPM:

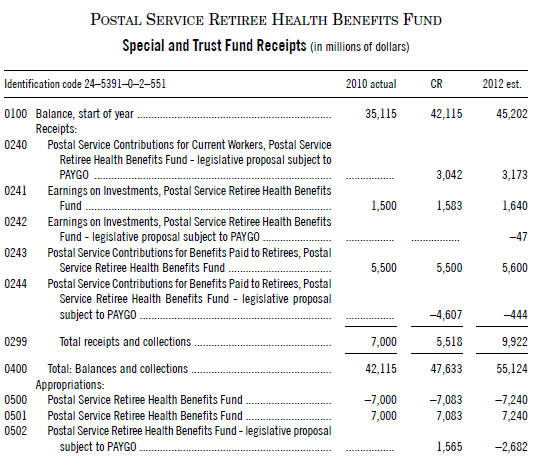

POSTAL SERVICE RETIREE HEALTH BENEFITS FUND

As a result of this health benefits financing system, beginning in 2017, the Postal Service will cease to pay annual premium costs for its post-1971 current annuitants directly to the Employees and Retired Employees Health Benefits Fund. Instead, these premium payments will be paid from amounts that the Postal

Service remits to this fund. Payments for a proportion of the premium costs of Postal Service annuitants’ pre-1971 service would continue to be paid by the General Fund of the Treasury through the Government Payment for Annuitants, Employees Health Benefits account.

The Budget proposes to shift how the Postal Service (USPS) pre-funds its retiree health benefits unfunded liability (UFL). Under current law, from 2011 to 2016, USPS must make a stream of payments set in statute toward paying down retiree health benefit unfunded liabilities, as well as pay annual premiums for current retirees. Also under current law, starting in 2017, USPS must pay the per capita accruing costs (or normal cost) to fund future retiree health benefits of current employees and a 40-year amortization of the remaining UFL for current retirees.

Under the proposal, starting in 2011, USPS would pay the normal costs for the future retiree health benefits of current employees and also a stream of payments associated with paying down the remaining UFL for current retirees. Further, USPS would be provided temporary financial relief as the 2011 payment would be adjusted so that USPS would pay $4 billion less than what it would have paid to this Fund under current law. USPS would make up this $4 billion payment to the Fund by paying larger amounts in future years. Beginning in 2022, USPS would pay the remaining UFL, amortized over 40 year period.

This proposal provides the following benefits to USPS: 1) USPS would be provided temporary financial relief in the form of a lower payment in 2011; 2) The new calculations of normal cost and UFL are based on new actuarial assumptions that reflect that USPS has fewer employees than in 2006, when the prefunding mechanism was originally adopted—therefore the actual annual payments for the normal costs would be reset each year based on the number of USPS employees; 3) This Fund would pay the premiums for current USPS retirees now, rather than starting in 2017—this accelerates what would have occurred anyway in 2017 under current law. See the Postal Service section of this Appendix for further information on this proposal.

good job mr. jameson!

Well said J JAMESON! The sheer logic and “common sense” though will totally baffle Congress……

J Jameson, you really need to publish this assessment and send it to all media and let every postal employee print a copy of this to send to their Senators and Congressmen. If only the public were aware of these facts, there would be such a different view of USPS. Thanks!

Mr. Jameson, I think you should be PostMaster General

I second that motion….

1.J Jameson – thank you

Well spoken J Jameson! Rock on!

Another rip-off ! The federally enabled “theft” of monies from the Postal Service continues. The Postal Service is set up to be a “stand alone” federal agncy in terms of taxpayer support. The Postal Service has neither taken or received government in decades.

Then, the Congress comes along in the person of Susan Collins, R- Maine, and passes legislation taking $5.5 billion away from the Postal Service and then they are aghast at why the Postal Service is in financial trouble.

Folks, this is Congressional theft, pure and simple.

According to the General Accounting Office, the auditing branch of Congress; and the Office of Inspector General, the Postal Service has been overcharged for retirement contributions by the Treasury between $50 and $60 billion dollars since about 1980.

So, if Congress removed the $5.5 billion charge, one that the Postal Service has been singled out for that no other federal agency pays; AND, pays back the $50 billion it owes the Postal Service for overcharging their retirement contributions; the Postal Service would be solvent.

There would be :

1) no closures of post offices in small towns

2) no closing of area mail plant processing, thus no delayed mail

3) no layoffs when there are already no jobs

4) the blue mail collection boxes would be put back in the neighborhoods

5) the federal government would be perceived as honest

6) the most respected government agency, the Postal Service, would go back to doing what one of the Founding Fathers designed it for, binding the country together.

7) the Postal Service would be in excellent financial health and free of Concressional meddling; and NOT be fixed until it breaks.

The payments are being spread out and repaid over 30 years. What a bunch of bullshit. All or part of the money that was overpaid is gone. Probably because the billions in overpayment into the fund were spent by greedy politicians. Thats my educated guess.